In 2023, "internal competition and excess" have become industry consensus. Whether it's electricity, industry and commerce, household energy storage, domestic or overseas markets, upstream materials and equipment, downstream components and integration.

Despite experiencing pains in 2023, the prospects for energy storage remain positive. China, the United States, Europe countries have issued a statement to increase their renewable energy installation targets. Major countries and regions such as China, the United States, Europe, and India have achieved unexpected growth in photovoltaic installation. Energy storage demand in emerging markets such as the Middle East, South America, Africa, and Southeast Asia is on the rise, and new energy storage technologies represented by lithium batteries are rapidly reducing costs, accelerating their penetration in segmented application scenarios and emerging markets.

GGII believes that the global energy storage market has entered a reshuffle period from a period of rapid development and will continue for the next 1-2 years. GGII predicts the top ten trends in China's new energy storage market in 2024 through industry analysis and research, combined with macro trends and enterprise data.

Prediction 1: It is expected that the global pre-meter installed capacity will increase by 40% in 2024, and the shipment of energy storage systems/batteries will increase by about 25%. The global shipment of energy storage systems will exceed 160GWh.

From the demand side, global pre-meter energy storage remains strong. In 2023, China, the United States, and Europe announced an increase in renewable energy construction. In the future, China and the United States will remain the main markets for pre-meter energy storage worldwide.

The US market, due to the highly dispersed and independent regional power grid, outdated facilities, and stronger demand for energy storage, is limited by factors such as grid connection difficulties, labor shortages, and supply chains. Despite high investment subsidies, the short-term installed capacity growth rate is limited, and there are still massive energy storage projects waiting to be connected to the grid. Driven by technological innovation and continuous cost reduction, China's cost of lithium-ion energy storage is approaching that of pumped storage, and its application scale will continue to expand.

Affected by the dual carbon strategy and regional energy structure, the demand for pre-meter energy storage in Southeast Asia, the Middle East, South Asia, Australia, South Africa, South America and other regions is also continuously increasing. It is expected that the global pre-meter installed capacity will still exceed the shipment growth rate in 2024, and the installed capacity will exceed 130GWh. The global shipment of energy storage systems (pre-meter and post meter) will exceed 160GWh, and the global shipment of energy storage batteries will exceed 200GWh.

Prediction 2: The global household storage market is showing a structural inventory state, and regional inventory will return to normal levels in H1 2024. It is expected that the global household storage lithium battery shipment will be 25GWh in 2024

The high expectations of the household storage market in 2023 have led to a continuous backlog of inventory among channel merchants. Due to differences in global demand, installation speed, and product certification, different regions exhibit a structured inventory distribution. It is expected that industry inventory will be fully depleted as early as January 2024 and no later than June 2024.

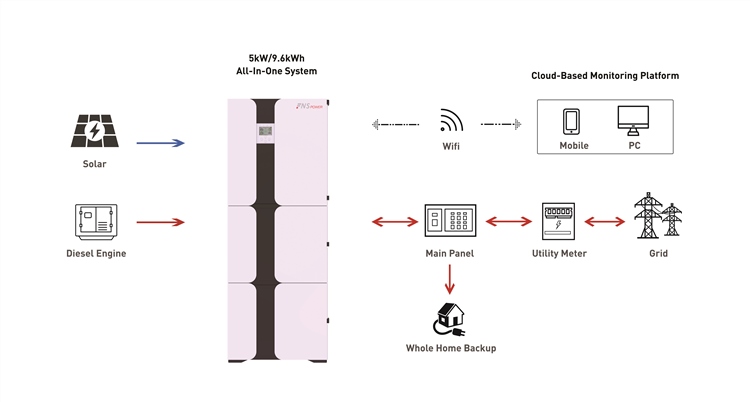

Residential ESS / Household ESS

In 2023, the US household storage market was affected by interest rate hikes and the NEM3.0 policy, resulting in a decrease in the willingness of households to install photovoltaic and energy storage units. It is expected that interest rate hikes will end in 2024, and the US market still has significant growth potential. It is expected that by 2024, the global household storage capacity will be 22GWh, and the shipment of household lithium batteries will be 25GWh.